Author: UK Hagerty Price Guide Editor, John Mayhead

This analysis is based on the UK Hagerty Price Guide which tracks over 3000 models of classic and collectable car, is updated quarterly and is published free here. Four values for each car are shown, ranging from ‘fair’ to ‘concours’ and are changed by a team who use insured values, public and dealer sales results, and other data to set prices.

Earlier trends have generally continued

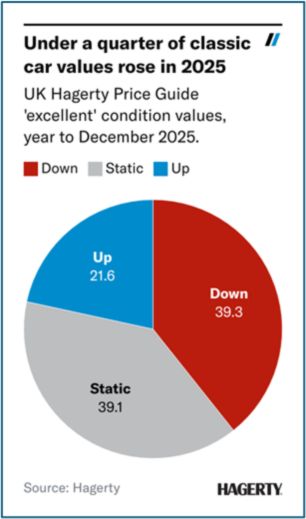

2025 has, in general, been an extension of what Hagerty saw in late 2024. The boom times of the post-Covid era are now firmly over, buyers are being much more careful with their money and, as a consequence, nearly 80 percent of values have either dropped or remained static. That said, delve a little deeper and certain areas emerge as hotspots, both up and down.

Modern classic cars tended to continue upwards

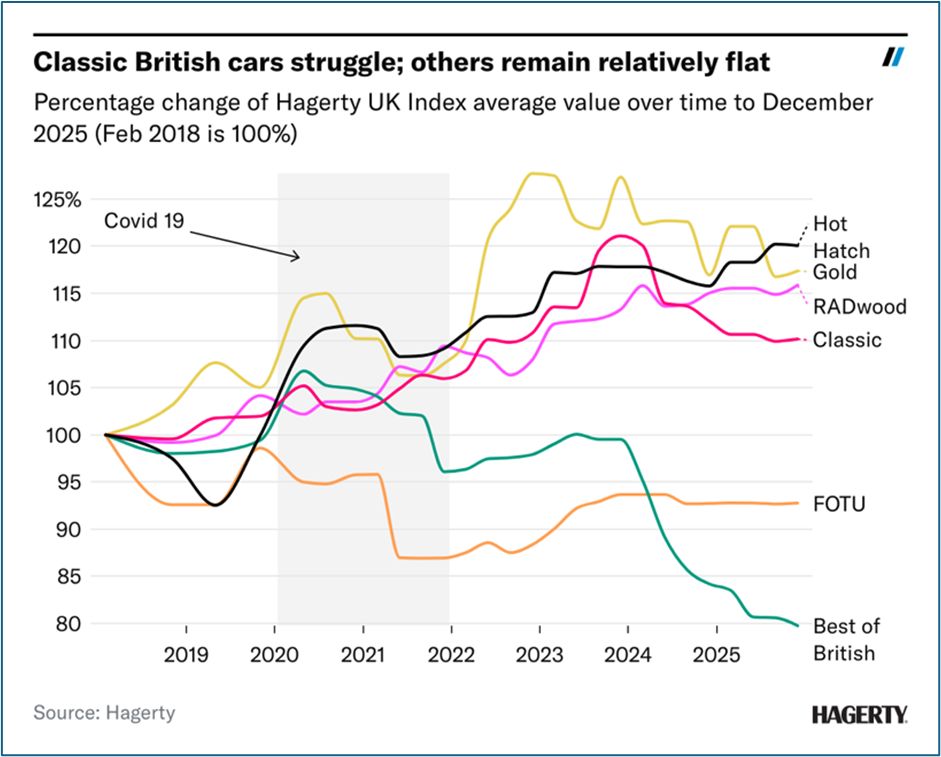

Hagerty’s UK Indices show that the growth tends to be happening in more modern classics: compared with December 2024, only two indices show meaningful growth: the Hot Hatch (HH – tracking predominantly 1980s and newer performance hatchbacks) and RADwood (RW – tracking 1980s and 1990s ‘turbo era’ cars) indices.

Classic British cars struggling

The Classic Index (CI), tracking the British enthusiast market segment, and the Best of British (BoB) Index, watching classic British cars like the Aston Martin DB5 and MGB, are both down, the BoB now at its lowest level since created in 2018. These two indices tend to have older cars: the mean age of first manufacture is 1962 for BoB and 1971 for CI, compared with 1987 for HH and 1988 for RW.

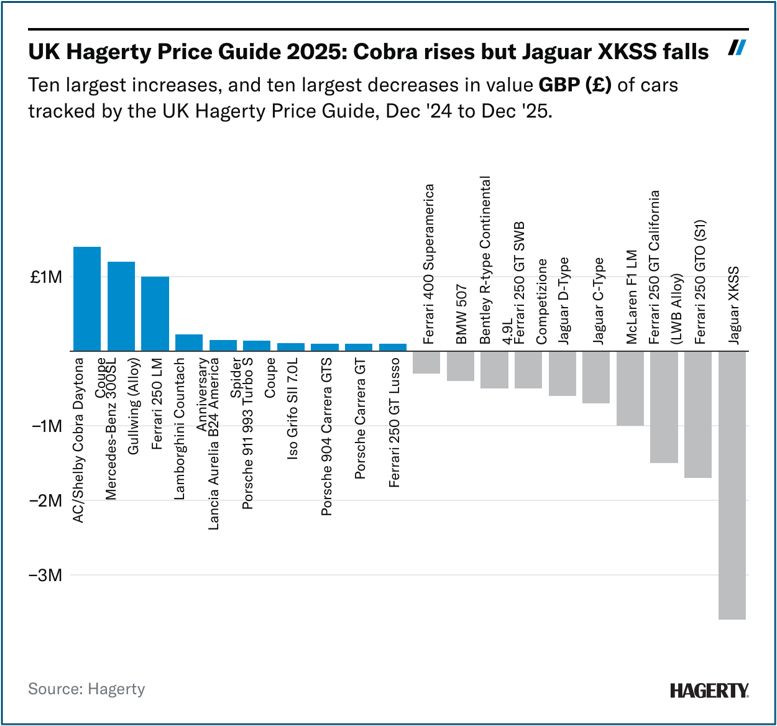

Across the entire 3000 models of the Hagerty Price Guide, the story is similar: a list of the manufacturers that have reduced, on average, most in the 12 months to December 2025 shows British brands taking nine of the ten places, with Bizzarrini the only foreign manufacturer making the list. Jaguar is the brand that has lost most this year, down 21.4 percent, in large part due to a -£3.6M reduction in the mean value of the XKSS, the largest downwards movement in value of any car in the price Guide. This followed the no sale of the 1957 XKSS at RM Sotheby’s London sale in November 2024, that was too late to affect the 2024 values, and the subsequent market movement following that auction. Jaguar C- and D- Types were also on the list of most significant falls in value during the period.

The Shelby Cobra Daytona coupe showed the largest value increase of any car in the Guide, pushed up by a number of significant Cobra sales at Kissimmee and Monterey during 2025, and the subsequent change to insured values.

Collectable car exports to the US were down

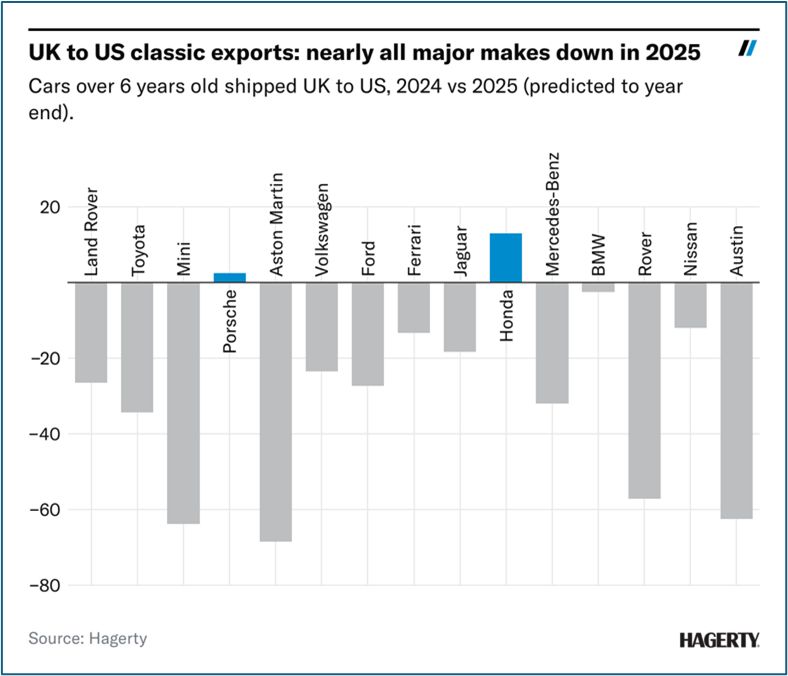

The number of older cars (over 6 years old) shipped from the UK to US fell to a six-year low in 2025, and reduced 14 percent compared with 2024. Of the 15 brands most usually shipped from UK to US, just Porsche and Honda rose, the rest fell. Land Rover remained the most shipped older car from the UK to US, accounting for 24.8 percent of all cars, followed by Porsche (6.7 percent) and Toyota (5.4 percent). Uncertainty over tariff regulations may well have affected export rates.

Records fell again at auction

Mercedes-Benz once again asserted their dominance at the top of the collectable car market with the sale, in February, by RM Sotheby’s of the 1954 W196R Stromlinienwagen (Streamliner) that sold for a shade over €51M (£45.1M), making it the second highest automotive public auction result after the 2022 sale of another W196R, the Uhlenhaut Coupe, for €135M (then £115M).

Ferraris performed well again, but there were strong late entries by the Gordon Murray Special Vehicles S1 LM that sold for $20.63M (15.7M) in November 2025, and two McLarens that sold in early December in Abu Dhabi. These included a record $25,317,500 (£19.4M) for a McLaren F1 with high downforce kit and $11.48M (£8.6M) for the 2026 McLaren Formula 1 MCL40A that will run in next season’s F1 championship. This joins the Gordon Murray S1LM as another car that doesn’t yet exist, the buyer purchasing ahead of construction.

It is notable that the top two auction sales were in the EU, two in the UAE and the remainder in the US. Meanwhile, British auctions at the top end have struggled with Bonhams Goodwood Revival returning the lowest total since 2016. It is possible that continued complexity of export requirements post-Brexit and possibly reduced market confidence here has pushed major sales overseas.

Summary

The very best cars still seem to be in demand, at almost every price point in the market, but uncertainty (both domestic and international) seems to have impacted on both sales and exports. Older cars, especially classic British cars, have tended to drop in value but some modern classics are still increasing in price as demand increases. But there hasn’t been a crash; unsustainable post-Covid prices have now returned to a realistic level, and that can be seen as a good thing for the hobby, as it may allow a wider range of cars to be accessible at a lower price point. Events are still thriving, and that’s a great sign.

For regular market updates or more information on anything covered, sign up to our newsletter.

Classic car insurance from Hagerty

Keep your classic on the road with expert classic car insurance built by car lovers, for car lovers. Rated ‘Excellent’ on TrustPilot.

Lets all remember, we who are the classic car nuts, get our enjoyment mostly out of owning, running repairing and of course driving out classics, its not just about how much they are worth, its about how much pleasure we get from out classics, and how much please we give the public from looking at them. Merry Christmas

Any good condition popular car of the 60’s onward that can keep up with modern road conditions should keep its value, they can be worked on without too much trouble, unlike cars made now which cost a fortune for parts even a mirror can be £200 plus, and as for the dozens of sensors which even a main dealer sometimes dosn’t fix it, the latest cars are a 10year thow away item, as for wet timing belts ? need I say more.

Thank you for a great article. Interesting to see some of the very top brands being reduced in value, as an avid Goodwood member from the humble beginnings and fan of historic racing, I’ve initially watched the value of cars such as top end Jaguars increase to what I would call, ‘out of control prices’ making them a fashion accessory for some buying for investment and moving them on, year by year. I’m pleased to see that the market is stabilizing and hopefully for some becoming more affordable. I’ve noticed at some car meets this year a significant number of younger enthusiasts entering the hobby which is great to see. I have a lower end classic, and a mid range classic, in the past I’ve also had higher value cars, but it’s always the everyday classics that get the best comments and interest from all age groups this is also helped by the availability of parts and no eye watering insurance costs. The hobby will continue and I believe adapt to the significant changes we are seeing in the automotive industry. Personally I don’t worry about the value of my cars, I regularly drive them and often commute in mine all year round, my belief is, if you keep driving, they will keep thriving…..